Scheduled to become compulsory on 1 January 2016, with a grace period until 30 June 2016, the I.C.E. (Identifiant Commun de l’Entreprise, Common Company Identifier) number will become the equivalent of the UTR number in the UK and EIN in the USA.And the Moroccan authorities have found a good way to force its use: if there is no ICE number on the invoice, it will not be deductible!

Recover your ICE number in just a few minutes online!

The ICE number is extremely easy to obtain if your company is too old to have been allocated one when it was set up.

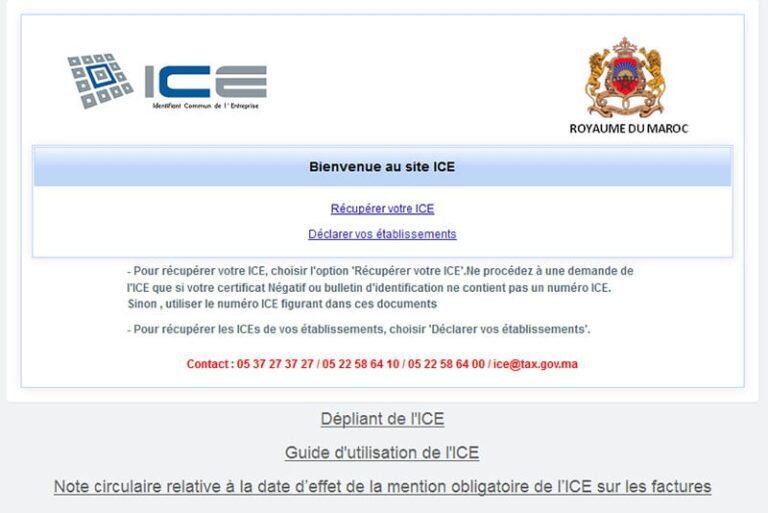

Simply go to www.ice.gov.ma and complete an online declaration to obtain a number. It’s simple, straightforward even, but it works!

On the home page there’s a link to a step-by-step manual with screen shots (very well done).

The ICE number is made up of 15 digits: the first 9 are the identification of the legal unit (the SIREN in France), then the establishments, in 4 positions (which will be equal to 0000 for companies with a single establishment), and finally a control key in two positions.

The first link, called ICE, corresponds to the unique number of the legal entity, which must be retrieved first. It is then possible to add establishments (second link, “Declare your establishments”).

Carefully armed with all or most of your existing identifiers (trade register number, tax identification number and CNSS registration number), you fill in an initial screen that will enable the programme to suggest your company in a list.

If your number has not yet been allocated to you, you can request it at this stage.

You then need to add an email address to receive your certificate. By the time the machine generates the ICE, you’re done in less than a minute, with a PDF certificate to save.

Well, almost…

I’ve tested for you… the little things that don’t work

So… the tax identification number must not begin with a zero, the programme is unable to delete it and coldly tells you “tax identification number does not exist, please contact ice@tax.gov.ma”.

It’s three o’clock in the morning, you’re blushing at the thought of having made false invoices for ten years, you rush over to the latest tax form, and bing… 0123456 <> 123456

As for the CNSS, I discovered a typo I’d never paid attention to: instead of being STE (for société/society) TARTEMPION, I’m DTE TARTEMPION.

At this point, you start to fear the worst when you click on ‘next’, but no, it’s ok.

Using the ICE

The ECI must therefore be shown on all invoices and external accounting documents if the charges are to be deductible. It must also appear on all tax returns and, more generally, on all documents on which it is necessary to identify the company and/or which may act as accounting evidence (proposals, quotations… website!).

It is also compulsory to indicate your customer’s ICE on any invoices you issue.

How do I check an ICE?

For the time being, the company receiving the invoice can only check its form. The ICE website allows you to retrieve your ICE if you know the other numbers, but not to search by ICE. You therefore have to search for a company by another identifier to access its ICE.

The directinfo.ma website, which provides access to the commercial register, does not display the ICE. Since this post was written, DirectInfo (published by OMPIC) has incorporated the ICE number.

There are also sites such as ICE Maroc, which allow you to find a company’s ICE from its name. However, you need to know the exact name of the company, whereas DirectInfo allows you to search using an ‘approximate’ name. What’s more, the site is completely anonymous and is hosted in France, so it is not an official site.

What’s more, this control of funds is not required by law.

The customer cannot therefore be required to check that the ICE number is real, nor can he be refused invoices if the ICE number is false.

That leaves debit notes and all those little receipts issued by the informal or formal sector, but without VAT… With the introduction of the ICE and electronic declarations, the tax authorities are trying to make life easier for taxpayers and, above all, to combat non-declaration and tax fraud.

This is no easy task, given that the informal sector still accounts for a large proportion of the country’s activity, and it is impossible to be “fiscally firm” if social peace is to be preserved.

ICE and VAT declaration

Your supplier’s ICE must be indicated on the VAT return. Since the beginning of 2020, businesses have also been required to file an annual return summarising their customer invoices with the ICE number. The authorities are preparing automated checks!

A typo or syntax error? You can select the text and hit Ctrl+Enter to send us a message. Thank you! If this post interested you, maybe you can also leave a comment. We'd love to exchange with you !

A typo or syntax error? You can select the text and hit Ctrl+Enter to send us a message. Thank you! If this post interested you, maybe you can also leave a comment. We'd love to exchange with you !